Polietilen ima različite vrste proizvoda na temelju metoda polimerizacije, razina molekularne težine i stupnja grananja. Uobičajene vrste uključuju polietilen visoke gustoće (HDPE), polietilen niske gustoće (LDPE) i linearni polietilen niske gustoće (LLDPE).

Polietilen je bez mirisa, nije toksičan, na dodir je poput voska, ima izvrsnu otpornost na niske temperature, dobru kemijsku stabilnost i može izdržati eroziju većine kiselina i lužina. Polietilen se može prerađivati injekcijskim prešanjem, ekstruzijskim prešanjem, puhanjem i drugim metodama za proizvodnju proizvoda kao što su filmovi, cijevi, žice i kabeli, šuplji spremnici, trake i vezice za pakiranje, užad, mreže za ribu i tkana vlakna.

Očekuje se pad globalnog gospodarstva. U kontekstu visoke inflacije, potrošnja je slaba, a potražnja smanjena. Osim toga, Federalne rezerve nastavljaju podizati kamatne stope, monetarna politika se pooštrava, a cijene roba su pod pritiskom. Osim toga, sukob između Rusije i Ukrajine se nastavlja, a izgledi su i dalje nejasni. Cijena sirove nafte je jaka, a trošak PE proizvoda i dalje je visok. Posljednjih godina, PE proizvodi su u razdoblju kontinuiranog i brzog širenja proizvodnih kapaciteta, a poduzeća koja se bave proizvodnjom gotovih proizvoda sporo prate narudžbe. Sukob ponude i potražnje postao je jedan od glavnih problema u razvoju PE industrije u ovoj fazi.

Analiza i predviđanje svjetske ponude i potražnje polietilena

Svjetski proizvodni kapacitet polietilena i dalje raste. U 2022. godini svjetski proizvodni kapacitet polietilena premašio je 140 milijuna tona godišnje, što je međugodišnje povećanje od 6,1%, s međugodišnjim povećanjem proizvodnje od 2,1%. Prosječna operativna stopa jedinice iznosila je 83,1%, što je smanjenje od 3,6 postotnih bodova u odnosu na prethodnu godinu.

Sjeveroistočna Azija čini najveći udio svjetskog kapaciteta proizvodnje polietilena, s udjelom od 30,6% ukupnog kapaciteta proizvodnje polietilena u 2022. godini, a slijede Sjeverna Amerika i Bliski istok s udjelom od 22,2% odnosno 16,4%.

Oko 47% svjetskih proizvodnih kapaciteta polietilena koncentrirano je u deset najvećih proizvodnih poduzeća s proizvodnim kapacitetom. U 2022. godini u svijetu je bilo gotovo 200 velikih poduzeća za proizvodnju polietilena. ExxonMobil je najveće svjetsko poduzeće za proizvodnju polietilena, koje čini otprilike 8,0% ukupnih svjetskih proizvodnih kapaciteta. Dow i Sinopec zauzimaju drugo i treće mjesto.

U 2021. godini ukupni međunarodni obujam trgovine polietilenom iznosio je 85,75 milijardi američkih dolara, što je međugodišnje povećanje od 40,8%, a ukupni obujam trgovine iznosio je 57,77 milijuna tona, što je međugodišnje smanjenje od 7,3%. S cjenovne perspektive, prosječna izvozna cijena polietilena u svijetu iznosi 1484,4 američka dolara po toni, što je međugodišnje povećanje od 51,9%.

Kina, Sjedinjene Američke Države i Belgija su glavni svjetski uvoznici polietilena, s udjelom od 34,6% u ukupnom svjetskom uvozu; Sjedinjene Američke Države, Saudijska Arabija i Belgija su glavne zemlje izvoznice polietilena u svijetu, s udjelom od 32,7% u ukupnom svjetskom izvozu.

Svjetski proizvodni kapacitet polietilena nastavit će brz rast. U sljedeće dvije godine svijet će dodati više od 12 milijuna tona proizvodnih kapaciteta polietilena godišnje, a ti projekti su uglavnom integrirani projekti koji se proizvode zajedno s uzvodnim postrojenjima za proizvodnju etilena. Očekuje se da će od 2020. do 2024. prosječna godišnja stopa rasta polietilena biti 5,2%.

Trenutno stanje i prognoza ponude i potražnje polietilena u Kini

Kineski proizvodni kapacitet i proizvodnja polietilena istovremeno su se povećali. U 2022. godini, proizvodni kapacitet polietilena u Kini povećao se za 11,2% u odnosu na prethodnu godinu, a proizvodnja se povećala za 6,0% u odnosu na prethodnu godinu. Krajem 2022. godine u Kini postoji gotovo 50 poduzeća za proizvodnju polietilena, a novi proizvodni kapaciteti u 2022. godini uglavnom uključuju jedinice kao što su rafinerija Sinopec Zhenhai, Lianyungang Petrochemical i Zhejiang Petrochemical.

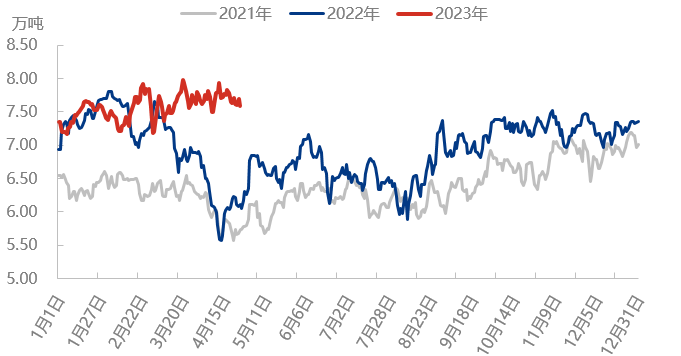

Usporedna tablica proizvodnje polietilena u Kini od 2021. do 2023.

Povećanje prividne potrošnje polietilena je ograničeno, a stopa samodostatnosti održava rast. U 2022. godini prividna potrošnja polietilena u Kini porasla je za 0,1% u odnosu na prethodnu godinu, a stopa samodostatnosti porasla je za 3,7 postotnih bodova u usporedbi s prethodnom godinom.

Volumen uvoza polietilena u Kini smanjio se u odnosu na prethodnu godinu, dok se volumen izvoza povećao u odnosu na prethodnu godinu. U 2022. godini, volumen uvoza polietilena u Kinu smanjio se za 7,7% u odnosu na prethodnu godinu; Volumen izvoza povećao se za 41,5%. Kina ostaje neto uvoznik polietilena. Kineska trgovina uvozom polietilena uglavnom se oslanja na opću trgovinu, što čini 82,2% ukupnog volumena uvoza; Sljedeća je trgovina preradom uvoza, koja čini 9,3%. Uvoz uglavnom dolazi iz zemalja ili regija poput Saudijske Arabije, Irana i Ujedinjenih Arapskih Emirata, što čini približno 49,9% ukupnog uvoza.

Polietilen se široko koristi u Kini, a folija čini više od polovice ukupne upotrebe. U 2022. godini tanka folija ostaje najveće područje primjene polietilena u Kini, a slijede je injekcijsko prešanje, profili cijevi, šuplji proizvodi i druga područja.

Kineski polietilen još uvijek je u fazi brzog rasta. Prema nepotpunim statistikama, Kina planira dodati 15 kompleta postrojenja za polietilen prije 2024. godine, s dodatnim proizvodnim kapacitetom od preko 8 milijuna tona godišnje.

Raspored proizvodnje novih domaćih uređaja PE za 2023.

Od svibnja 2023. ukupni proizvodni kapacitet domaćih PE postrojenja dosegao je 30,61 milijuna tona. Što se tiče širenja PE-a u 2023. godini, očekuje se da će proizvodni kapacitet biti 3,75 milijuna tona godišnje. Trenutno su u pogon pušteni Guangdong Petrochemical, Hainan Refining and Chemical i Shandong Jinhai Chemical, s ukupnim proizvodnim kapacitetom od 2,2 milijuna tona. To uključuje uređaj pune gustoće od 1,1 milijuna tona i HDPE uređaj od 1,1 milijun tona, dok LDPE uređaj još nije pušten u pogon tijekom godine. U drugoj polovici sljedeće godine još uvijek postoje planovi za proizvodnju 1,55 milijuna tona/godišnje nove opreme, uključujući 1,25 milijuna tona HDPE opreme i 300 000 tona LLDPE opreme. Očekuje se da će ukupni proizvodni kapacitet Kine do 2023. godine dosegnuti 32,16 milijuna tona.

Trenutno u Kini postoji ozbiljna kontradikcija između ponude i potražnje PE-a, s koncentriranim proizvodnim kapacitetima novih proizvodnih jedinica u kasnijoj fazi. Međutim, industrija downstream proizvoda suočava se sa zastojem u cijenama sirovina, niskim narudžbama proizvoda i poteškoćama u povećanju cijena u maloprodaji. Smanjenje operativnog prihoda i visoki operativni troškovi doveli su do ograničenog novčanog toka za poduzeća, a posljednjih godina, u kontekstu visoke inflacije, politika pooštravanja monetarne politike povećala je rizik od ekonomske recesije, a slaba potražnja dovela je do smanjenja narudžbi proizvoda u inozemnoj trgovini. Poduzeća downstream proizvoda, poput PE proizvoda, nalaze se u razdoblju industrijskih problema zbog neravnoteže ponude i potražnje. S jedne strane, moraju obratiti pozornost na tradicionalnu potražnju, dok su razvoj nove potražnje i pronalaženje izvoznih smjerova postali...

Od udjela distribucije potrošnje PE-a u Kini, najveći udio potrošnje otpada na foliju, a slijede glavne kategorije proizvoda poput injekcijskog prešanja, cijevi, šupljih materijala, izvlačenja žice, kabela, metalocena, premaza itd. Za industriju folija, glavni trend su poljoprivredne folije, industrijske folije i folije za pakiranje proizvoda. Međutim, posljednjih godina potražnja za tradicionalnim proizvodima od plastičnih folija za jednokratnu upotrebu postupno je zamijenjena popularnošću biorazgradive plastike zbog ograničenih propisa o plastici. Osim toga, industrija folija za pakiranje također je u razdoblju strukturne prilagodbe, a problem prekapacitiranosti u proizvodima niže klase i dalje je ozbiljan.

Industrija injekcijskog prešanja, cijevi, šupljih dijelova i drugih industrija usko je povezana s potrebama infrastrukture i svakodnevnog civilnog života. Posljednjih godina, zbog čimbenika poput negativnih povratnih informacija o potrošačkom raspoloženju stanovnika, razvoj industrije proizvoda suočio se s određenim preprekama rastu, a nedavno ograničeno praćenje izvoznih narudžbi također je dovelo do mogućnosti usporavanja rasta u kratkom roku.

Koje su točke rasta domaće potražnje za PE u budućnosti?

Zapravo, na 20. nacionalnom kongresu krajem 2022. predložene su razne mjere za poticanje domaće potražnje, s ciljem otvaranja unutarnje cirkulacije u Kini. Osim toga, spomenuto je da će povećanje stope urbanizacije i opsega proizvodnje potaknuti potražnju za PE proizvodima iz perspektive promicanja unutarnje cirkulacije. Osim toga, sveobuhvatno ublažavanje kontrole, gospodarski oporavak i očekivano povećanje potražnje za unutarnjom cirkulacijom također pružaju politička jamstva za budući oporavak domaće potražnje.

Nadogradnja potrošača dovela je do rastuće potražnje, s većim zahtjevima za plastikom u područjima kao što su automobili, pametni domovi, elektronika i željeznički prijevoz. Visokokvalitetni, visokoučinkoviti i ekološki prihvatljivi materijali postali su preferirani izbor. Potencijalne točke rasta za buduću potražnju uglavnom su u četiri područja, uključujući rast ambalaže u industriji ekspresne dostave, ambalažne folije potaknute e-trgovinom i potencijalni rast potražnje za vozilima na novu energiju, komponentama i medicinskom opremom. Još uvijek postoje potencijalne točke rasta za potražnju za PE-om.

Što se tiče vanjske potražnje, postoje mnogi neizvjesni čimbenici, poput odnosa Kine i SAD-a, politike Federalnih rezervi, rata između Rusije i Ukrajine, geopolitičkih čimbenika itd. Trenutno je kineska vanjska potražnja za plastičnim proizvodima još uvijek usmjerena na proizvodnju proizvoda niže klase. U području vrhunskih proizvoda, mnoga stručnost i tehnologija još uvijek su čvrsto u rukama stranih poduzeća, a tehnološka blokada vrhunskih proizvoda relativno je ozbiljna. Stoga je to i potencijalna točka proboja za budući izvoz kineskih proizvoda, gdje koegzistiraju prilike i izazovi. Domaća poduzeća i dalje se suočavaju s tehnološkim inovacijama i razvojem.

Vrijeme objave: 11. svibnja 2023.